A differentiated approach

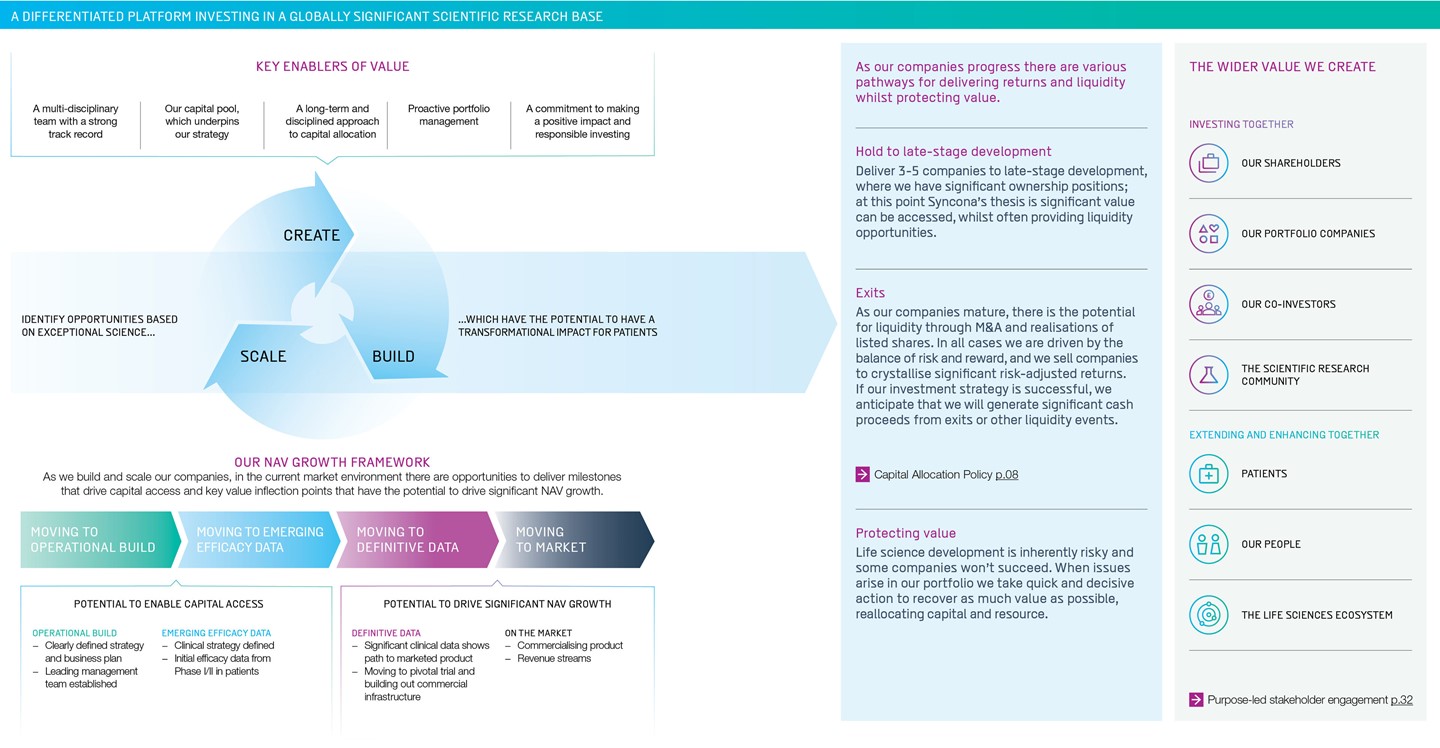

We are focused on maximising value at all points of the investment cycle to deliver transformational treatments to patients, capture superior risk-adjusted returns for shareholders and build long-term value for all our stakeholders.

The core premise of our investment strategy is that significant risk-adjusted returns come when highly innovative technology is developed into a late-stage clinical product. Our model is to identify exceptional science and create or add companies which have the potential to develop products to late-stage development, where significant value can be accessed.

Rolling 10-year targets

3

New companies created or added per year

20-25

Portfolio of leading life science companies

3-5

Companies to late-stage development